Part 9 – Buying and Holding

How do I keep my crypto safe from hackers? and where should I buy my crypto?

Over the last 9 weeks we have been diving deep into the crypto space. Risks, benefits, the changing world order.

We have covered a lot!

I have one last piece of knowledge that you need to know in order to best invest in cryptocurrency: How do I buy and store my crypto?

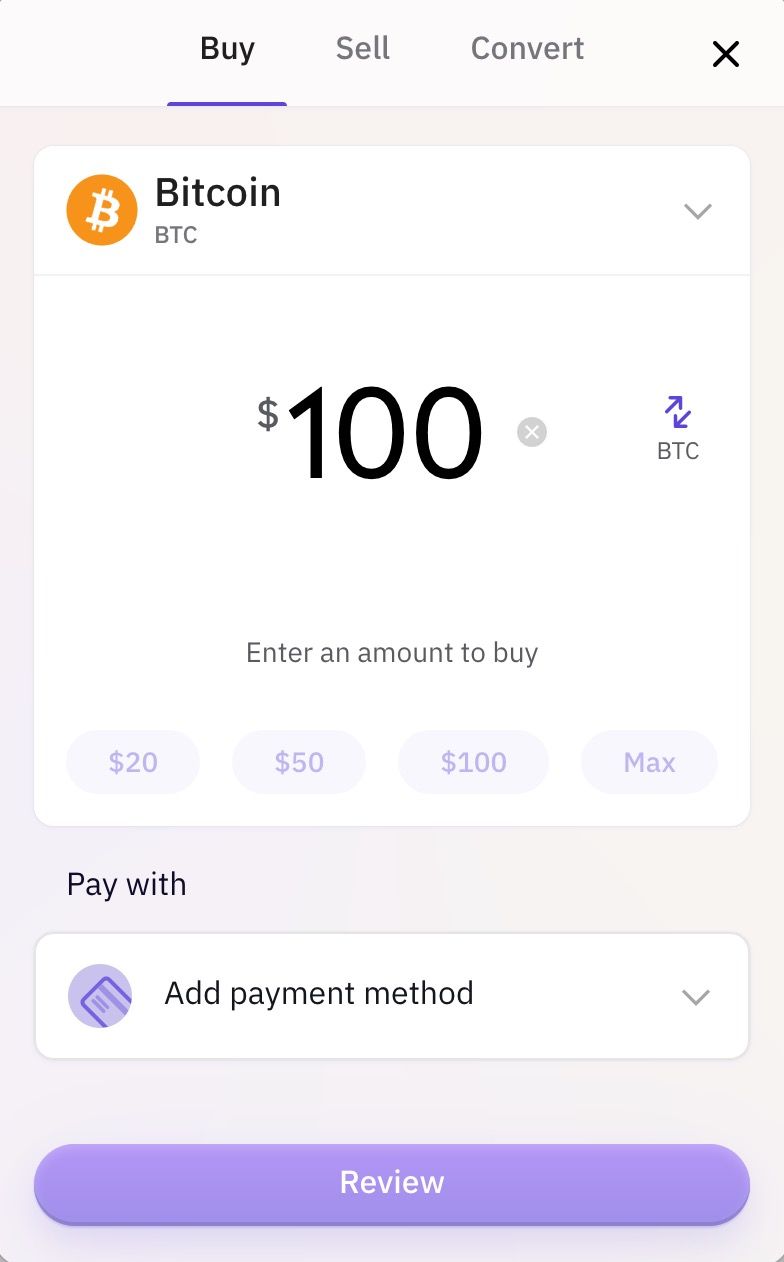

Buying Crypto

This process is very easy with most major exchanges.

Set up an account, send required documentation to them, and press buy!

My favorite exchanges:

- Coinbase

For beginners, coinbase cannot be beat. they have an automatic DCA feature allowing you to set the amount you want to invest each week or month, to spread out your cost basis. - Kraken

Kraken is my personal favorite for large sums of money. coinbase is great for the beginner with a small portfolio, however Kraken features the ability to wire money in and out relatively easily. They also have a professional trading interface for setting stop losses and take profits (which are outside the scope of this series).

Outside of those two, there are some decentralized exchanges (Called DEX's), these are where you will be purchasing tokens that have not listed on major exchanges. Uniswap is among the most popular, there are also exchanges outside of the Ethereum ecosystem.

I am mentioing this just to let you know they exist, for beginners: stick with Coinbase, Kraken, Gemini, etc.

Only once you have more experience should you consider DEX's, they are not as safe, and have a much steeper learning curve. especially come tax season.

New Exchange listings – A warning

Coinbase, Kraken, Binance, Kucoin, etc. these are centralized exchanges. they are owned and operated by companies who do KYC (know your customer. they take information from you to show the government that they know who us using their platform, to put it simply).

Because these are more accessible to the average user, they are also much more heavily used than DEX's.

When a new token is released on one of these major exchanges, it rapidly increases the volume of the token. More eyes and wallets have access to this now.

Because of this, new listings on exchanges tend to have a steep run up and then massive decline in price within a day or two of listing.

If you remember the previous section on volume, you will know why: In order to sell an asset, someone else has to want to buy it.

Put yourself in the shoes of an early investor in a new crypto project. We'll call it Fake token (with a ticker of $FAKE).

You buy Ethereum on Kraken, send it to your metamask wallet, and trade it on uniswap (paying gas fees along the way), now you have traded your ETH for FAKE. the price is $0.01/FAKE.

Once the news hits that FAKE will be listed on Coinbase, the price rises to $1 (a 9900% increase in price). You invested $1,000 originally and now you have $100,000! As soon as you can, you send your FAKE to coinbase and sell it to all of the new users who are eager to buy this trending token.

Everyone who invests early does this, for that reason I would recommend avoiding new listings. once they cool down, they will have another chance to increase in price. but buying a token which is "new" will almost always result in a major loss.

Holding your crypto

Now that you have purchased some crypto-currency, you will need to move this crypto to your crypto wallet (unless you plan to trade it quickly).