Part 3 – The Changing World Order

The US dollar has been weaponized, peace treaties are being formed between foreign powers, and China is watching very closely. How will this impact your investments?

The Changing World Order

On September 17th, 2017 Ray Dalio, the founder of Bridgewater Associates, one of the world's largest hedge funds, published a book called “Principles”.

In this book, Dalio outlined his principles for life and work that he developed systematically over the course of his incredibly successful career. This book changed the way I think about my life and relationship to integrity, work, and leadership.

I highly recommend Principles (which you can buy here, or start your free trial of audible and get the audio book version)

However principles is not the reason I bring Ray Dalio up in this article.

Rather It is because of his most recent work: The Changing World Order. The changing world order is a monumental work. In short it is Dalio’s extensive study of the history of the rise and fall of empires, and the events that precede them.

He traces the history of the Dutch Empire, the British Empire, the American Empire, and the swiftly rising Chinese Empire (among others). What he uncovered in this landmark novel are the commonalities between all of these Empires and the events that lead to their rise, sustained success, and eventual decline.

I am going to lay out the most important details of his book in the context of this series and how it relates to the future of crypto-currency and other investments. However if you would like the full scope of his study, I highly recommend you buy the book. Warning though, it is a lengthy and dry read.

If that does not sound appealing to you, you’re in luck. Dalio released a 45 minute youtube video summarizing his study. I highly recommend you watch it before we move forward. I will be summarizing some parts of the video and book for this chapter, and it will help quite a bit for you to have a primer.

"The Changing World Order" is a comprehensive analysis of the global economic and political landscape, which highlights the rise and fall of different empires and the current shift of power from the West to the East.

Dalio believes that the world order is changing at a rapid pace, and this shift will have profound implications for investors, businesses, and governments. In his analysis, he identifies three major forces driving this change: debt, inequality, and populism.

According to Dalio, the world has been in a debt cycle for the past few decades, with governments and individuals accumulating high levels of debt. This debt burden has led to an environment where economies struggle to grow, and interest rates remain low. This low-growth environment has led to rising inequality, with the wealthy few benefitting from the system while the middle class and poor suffer.

In response to this inequality, populism has risen across the world, with people demanding change and a fairer system. This has resulted in the rise of nationalist and protectionist policies, with countries looking inward and focusing on their own interests.

Dalio argues that the rise of China as a global power is a significant factor in this changing world order. He believes that China's rise is inevitable and will lead to a shift in the global economic and political landscape. China's economic power is growing rapidly, and it is investing heavily in infrastructure, technology, and education. This has led to a significant shift in the balance of power, with the West losing its dominant position.

America The Super Power

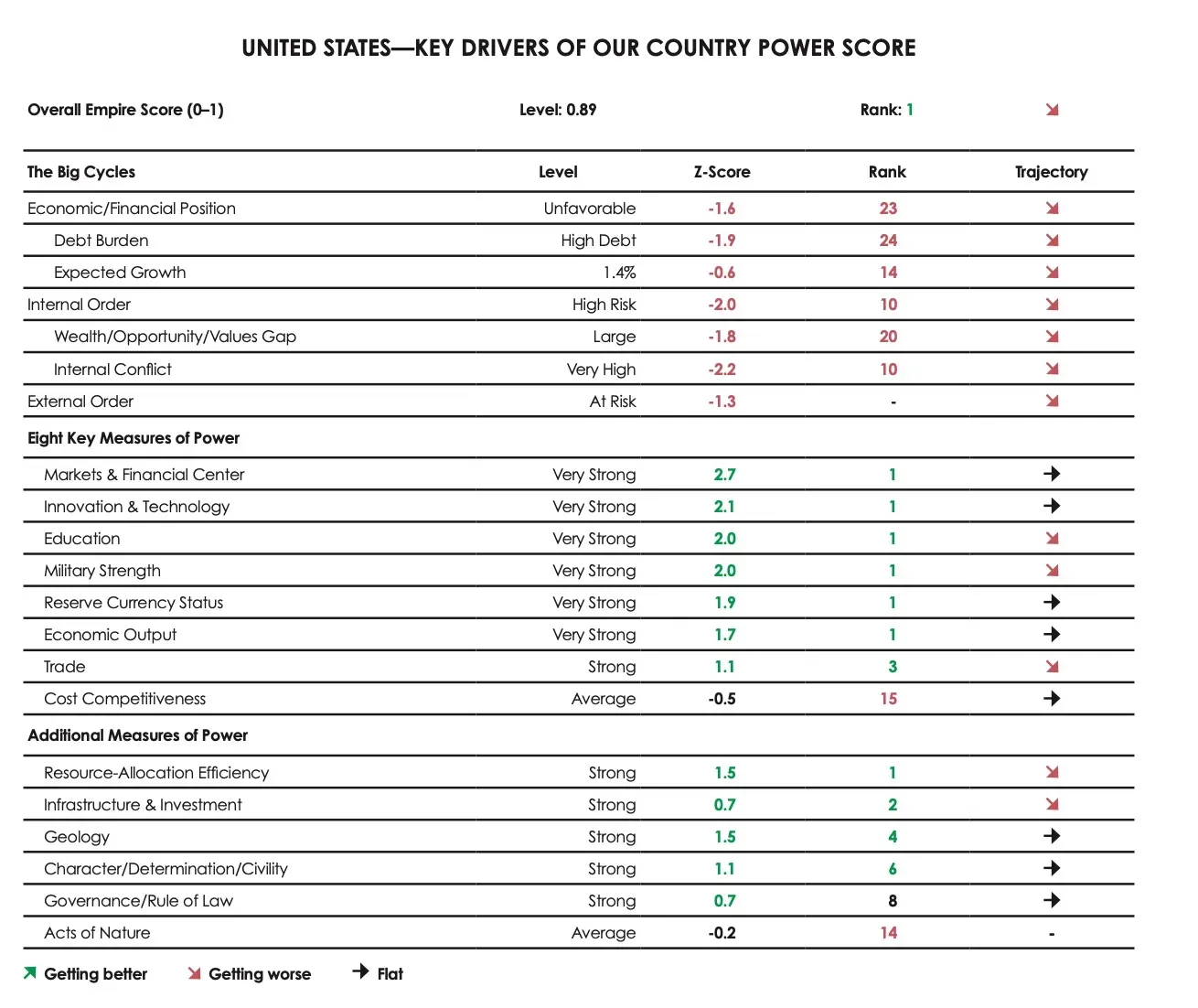

While I have spent many hours pouring over metrics to rank America among its peers, However I will give the floor to Dalio here. He has created an entirely new metric which he has coined the “Country Power Score”. (the US table is found below):

In Dalios words (linked is his World Power Score Index 2023):

the United States appears to be a strong power (#1 among major countries today) in gradual decline. […] the key strengths of the United States that put it in this position are its strong capital markets and financial center, its innovation/technology, its high level of education, its strong military, its reserve currency status, its high economic output, and its wealth of natural resources. Its weaknesses are its unfavorable economic/financial position and its large domestic conflicts. The eight major measures of power are very strong today but are, in aggregate, falling slowly.

”The United States is in an unfavorable position in its economic and financial cycles, with a high debt burden and relatively low expected real growth over the next 10 years (1.4% per year). The United States has significantly more foreign debts than foreign assets (net IIP is -68% of GDP). Non-financial debt levels are high (267% of GDP), and government debt levels are high (122% of GDP). The bulk (99%) of these debts are in its own currency, which mitigates its debt risks. The ability to use interest rate cuts to stimulate the economy is modest (short rates at 4.9%). That said, being the world’s leading reserve currency is a large benefit to the US. If this were to change, it would significantly weaken the US position.

Internal disorder is a high risk. Wealth, income and values gaps are large (relative to countries of similar per capita income levels). Regarding inequality—the top 1% and top 10% in the United States capture 19% and 45% of income (respectively the 8th and 11th highest share across major countries). Our internal conflict gauge is very high. This gauge measures actual conflict events (i.e., protests), political conflict (i.e., partisanship), and general discontent (based on surveys).

External disorder is a risk. Most importantly, the United States and China, which is fast-rising and the #2 power (all things considered), are having significant conflict as measured by our external conflict gauge. One example of this is that 79% of Americans today have an unfavorable view of China (up from 45% in 2018).”

I want to state, for the record, that I am not writing a US hit piece. But when looking at the potential downfall of the American empire and replacement by the rising Chinese Empire, it is worth noting the ways in which America is lacking and additionally the ways in which we are declining. Keep in mind the time horizon is long, this is not an instantaneous (or certain) demise.

Though Dalio's phrasing tends towards the humble, his warning is much more dire than it appears. The timeline may not be 1-2 years, and this is a good thing for us, but only if we heed the warning and take action now. Once America hits a sharp down trend, there will be no time to develop a back up plan. The time to position yourself for the next 5-10 years is now. Major investors (such as Warren Buffet) have already begun repositioning their portfolios in alarming ways, and we all should be too.

Risk of War

I do not believe that America is on the brink of immediate collapse. I do believe, however, that we are about to face economic and political competition (the BRICs alliance among others, which I will discuss a little later) in a time where we are not at our strongest. This does put the US at a disadvantage, and we are not paying attention to the important areas of national strength at the moment. Education has been underfunded for a very long time (America is 13th in education, which is a steep drop in the last 13 years. in 2010 we were 6th, and 2nd in 1990), our Infrastructure has certainly seen better days, and we are have been seeing an ever widening gap between the rich and poor with the middle class simply disappearing in the divide. On top of that, and to Dalios point, we are seeing our political divide widen even further as we become increasingly polarized as a nation. Our debt burden is mounting, and any change to the US reserve currency status would be catastrophic for our economy and the value of our Dollar.

I do not think we are heading for WWIII. There are plenty of reasons to believe that this war will be waged less violently than its predecessors. the risk of a global war is non-zero, however. The more diversity you have in your portfolio, the better you will fare in any type of environment (even during a global war).

Because of Mutually assured destruction, we will likely not see a global war on the level we have seen in the past. However, it remains to be seen whether China or some other country will develop an asymmetrical advantage that will turn the tables in their favor. In all likelihood these advantages will not be military, but technological. Some even believe that TikTok was designed specifically as a disinformation campaign, or to undermine American youth. This is not all that far fetched when considering the differences between the TikTok app in China, which features almost exclusively educational and patriotic content, and the app in America. According to Tristan Harris, A former google employee and social media ethics advocate:

“There’s a survey of pre-teens in the U.S. and China asking, ‘what is the most aspirational career that you want to have?’ and in the U.S., the No. 1 was a social media influencer, and in China, the No. 1 was astronaut,” Harris said. “You allow those two societies to play out for a few generations and I can tell you what your world is going to look like.”

The use of TikTok as a propoganda tool may seem trivial and alarmist, but one thing is clear: The way this war will be waged seems to be something we have never encountered before.

US Based Investments and the US Dollar

Dalio's analysis highlights the growing debt burden and rising inequality in the United States, which is likely to have long-term implications for economic growth and stability.

Will we see massive drops in stocks across the board? hyper-inflation? Famine, Locusts and Boils?

I will reiterate for the hundredth time: no one knows the future.

However, looking back at history we can take a look at future probabilities. One such probability is the decline of the US dollar. In Dalio’s words:

“What does that mean for the US Dollar? will it decline and be replaced?

Most probably it will decline analogously to past reserve currency declines: Slowly for a long time and then very quickly”

Dalio runs a very complicated formula to calculate the Debt burden of each nation. His conclusion is this: The US has the highest debt burden, and downward pressure on its reserve currency status. The US’s debt is denominated in USD, which is the reserve currency (currently), which gives it the ability to print more money to pay its debts. This puts the currency at risk of devaluation which puts the US in great risk of a downward spiral.

The US prints more and more money to pay its debts, this devaluates the currency heavily (consider the covid stimulus packages compared with the massive inflationary spike that followed), then the US loses reserve currency status. This would limit or remove the US’s ability to print new money to pay old debts which would put it at risk of default on those debts along with a severely devalued currency.

Like a tangled necklace, this entire system is interconnected: Defaulting on debts, losing reserve currency status, greatly devalued US dollar, rising inequality, lowering education… the picture gets bleak pretty quickly.

“…I think the odds of the US devolving into a stage 6 (Civil-war-type) dynamic within the next 10 years is only around 30%, that is a dangerously high risk that must be protected against…” – The Changing World Order p. 482

BRICs

BRICs is a term coined by economist Jim O'Neill to refer to the emerging economies of Brazil, Russia, India, and China. These four countries are projected to become major economic powers in the 21st century, with the potential to rival the economic power of the United States and other developed nations.